- Print

Article summary

Did you find this summary helpful?

Thank you for your feedback!

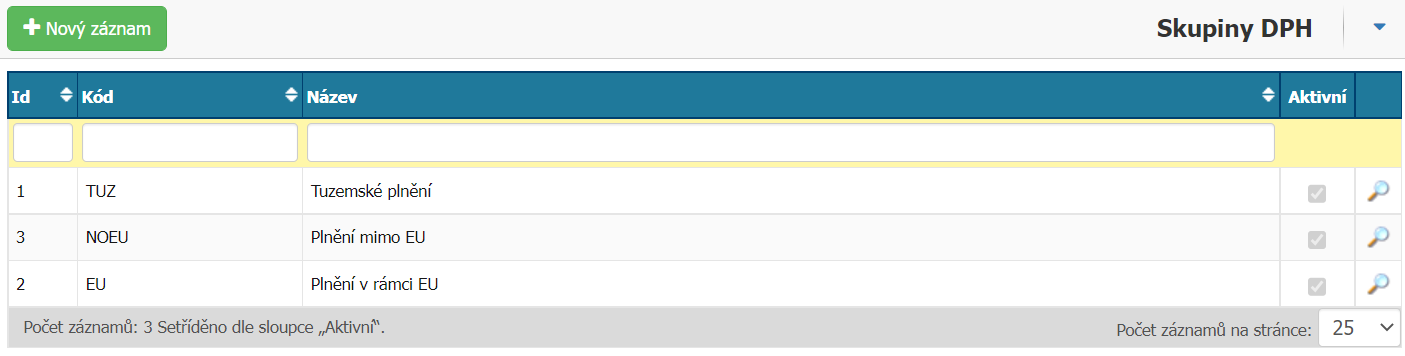

VAT groups are used for further breakdown, usually when multiple VAT rates are introduced in the system. They are also linked to the accounting systems. Example: ** Domestic transactions, Transactions within the EU, Transactions outside the EU**. In the VAT Groups form we have the option to filter the records above each column and click on the column name to enable ascending or descending sorting according to that column.

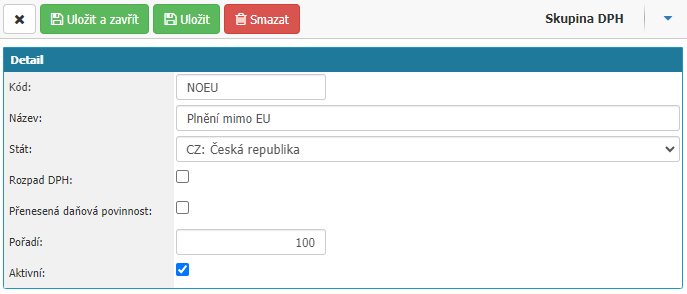

A new VAT group entry can be created by pressing the New record button and filling in the parameters:

- Code - VAT group code

- Name - name of the VAT group

- State - country of the VAT group

- VAT breakdown - enables VAT breakdown for the group

- Tax liability transfer - allows the transfer of tax liability for the VAT group

- Order - determines the order in the list of VAT groups

- Active - allows control of the VAT group activity

Was this article helpful?